- Latest ESG News

- Sitemap

- Stakeholder Service

- Management Commitment and Philosophy

- Sustainability Performance

- Corporate Sustainability Management

- Corporate Governance

- Sustainable Supply Chain Management

- Conflict Minerals Management

- Sustainable Envrionment

- Talent Transition and Happiness in Workplace

- Social Participation

- Interactive zone

- Policy and Certificate

- Sustainability Report

Corporate Governance

▶️Accountability for Integrity Win-Win in Profit ▶️Board of Directors Operation ▶️Risk Management

▶️Integrity and Ethics ▶️Information Security Management

The highest governance body of WPG Holdings is the Board of Directors, which is led by the chairman who supervises the implementation of diverse corporate governance affairs. In addition to the establishment of independent directors, various committees are also instituted to be responsible for the Company's main operational topics; the Board of Directors is in charge of supervising the Company's overall operations and affairs, and makes decisions on main investments, mergers, and acquisitions, etc. The Board of Directors at the same time oversees the management team and keeps an eye on the situation including domestic and foreign legal changes. The responsibilities of the chairman and the CEO are distinctly divided. The CEO is a professional manager who implements the decisions of the Board of Directors, in command of business results within the scope of authorization.

The Company’s Board of Directors re-elected the whole directors on May 31, 2023. 9 directors of 7th Board of Directors (including 4 independent directors). The Board of Directors has convened a total of 12 meetings in 2024. The directors’ attendance rate attained 99.07% (exclusive of the attendance by proxy). According to Article 38 of the Company's Corporate Governance Best Practice Principles: "The in-person attendance rate of all directors of the company shall be at least 80%"” and the interests of directors are avoided in accordance with legal requirements. For more information on the Board of Directors, please refer to the Company's Annual Report.

Diverse Backgrounds of the Directors

The selection and nomination of the Company’s Board of Directors is based on the provisions of the Company’s Articles of Incorporation, the Rules Governing the Election of Directors and the Corporate Governance Best-Practice Principles, and a candidate nomination system is used to elect directors in a fair, impartial and open process. The Company has established the “Method for Election of Directors” and the “Corporate Governance Best Practice Principles ,” which provides for a diversified approach to the composition of the Board of Directors. Based on the Company’s operations and development needs, and taking into consideration the views of stakeholders, the Company plans the appropriate composition of the Board of Directors and their successors by determining the professional background, expertise, industry experience, gender, age, and nationality of the directors.

In accordance with Article 20, Section 4 of the Company’s “Corporate Governance Best Practice Principles ,” the Company’s policy on diversity of board composition includes, but is not limited to, the following two major criteria :

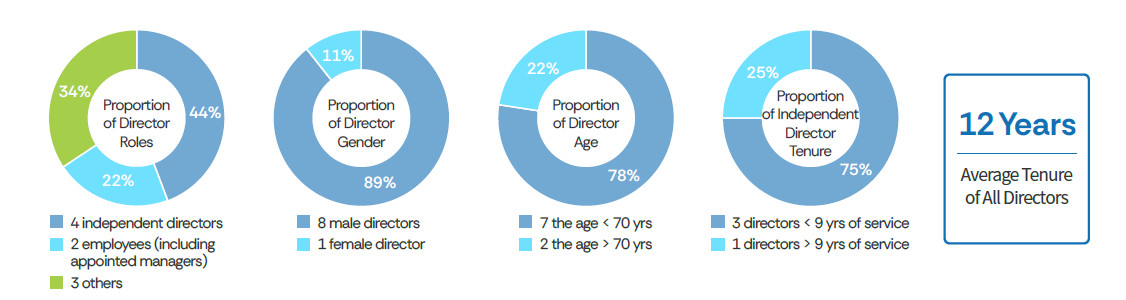

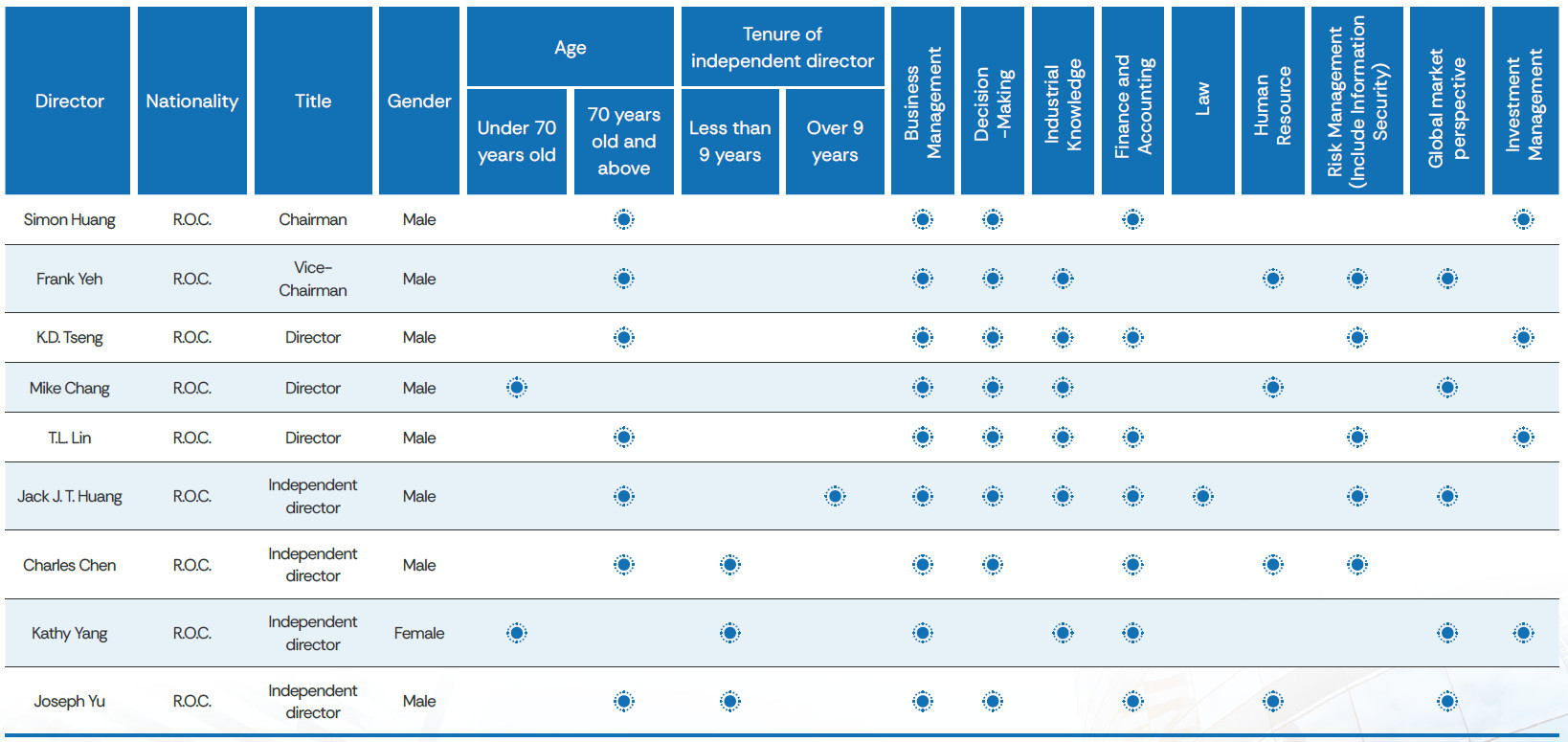

Board members should generally possess the knowledge, skills and qualities necessary to carry out their duties. In order to achieve the desired goals of corporate governance, the Board of Directors as a whole should possess the following competencies: operational business judgment, accounting and financial analysis, operational management, crisis management, industry knowledge, international market perspective, leadership, and decision-making ability. The 7th Term Board of Directors of WPG Holdings was elected by the shareholders’ meeting on May 31, 2023 for a three-year term from May 31, 2023 to May 30, 2026. The 7th Board of Directors consists of 9 members (including 4 independent directors) with expertise in investment management, strategic management, finance and accounting, legal and international market perspectives in addition to the electronic components industry. 2 directors (22%) are also the Company’s employees (including appointed managers). There are 4 independent directors (44%), 8 male directors (89%) and 1 female director (meeting the goal, 11%). 7 directors attain the age more than 70 years old (78%), and the other 2 directors less than 70 years old (22%). There are 3 independent directors with less than 9 years of service and 1 with more than 9 years of service, and the average length of service of all directors is 12 years.

The four independent directors are Jack J.T. Huang, the founder and chairman of Taiwan Renaissance Platform Co., Ltd., Charles Chen, the former vice president of PwC Taiwan, Kathy Yang, the former President of CDIB Capital Management Corporation, and Joseph Yu, Distinguished Professor of Chang Gung University.

Among them, Mr. Jack J.T. Huang has served as the Company’s independent director for three consecutive terms of office or more. Notwithstanding, upon evaluation on his participation in the operation of the Board of Directors and independence status, it is found that he meets the independence requirement and never establishes certain relationship with the management (or any others) that might compromise his ability to make impartial judgment or perform job duty impartially in the best interest of the Company. Considering that he has expertise in law and M&A, and is experience in relevant laws and business management, he may provide forward-looking and fair important opinions on the Company’s operational development, continue to provide suggestions and supervision to the functional committees under the Company’s Board of Directors, and continue to improve the transfer of experience in a more comprehensive corporate governance mechanism.

Note 1 : In accordance with Taiwan's Regulations Governing Appointment of Independent Directors and Compliance Matters for Public Companies, no independent director of the Company may concurrently serve as an independent director of more than three other public companies.

Note 2 : For the information on directors holding concurrent positions in other companies, please refer to the Shareholders Meeting Annual Report - Information on Directors.

Succession Planning for Board Members

For the Company's subsidiaries with a single corporate shareholder (e.g., WPI Group, SAC Group, AIT Group, and YOSUN Group ), the Company has established a policy for supervising the board of directors of subsidiaries and the principles for assignment principles since 2013. Through assigning senior executives of subsidiaries to serve as directors of subsidiaries and participating in the operation of the board of directors of subsidiaries, the executives are able to familiarize themselves with corporate governance and the duties of directors, and further develop the management and professional abilities required to serve as a director. The Company also invites the directors and supervisors of subsidiaries and key management to participate in the director training programs. In the past, we have established cases in which the CEOs of WPG subsidiaries became CEO of WPG Holdings and served as directors. By strengthening the governance of our subsidiaries' boards of directors, we have been able to build up a pool of talented directors for the Company.

The Company also conducts extensive recruitment of specific legal, financial, accounting, investment, and international development professionals based on the Company's operational development needs to serve as a source of talent pool for future director selections.

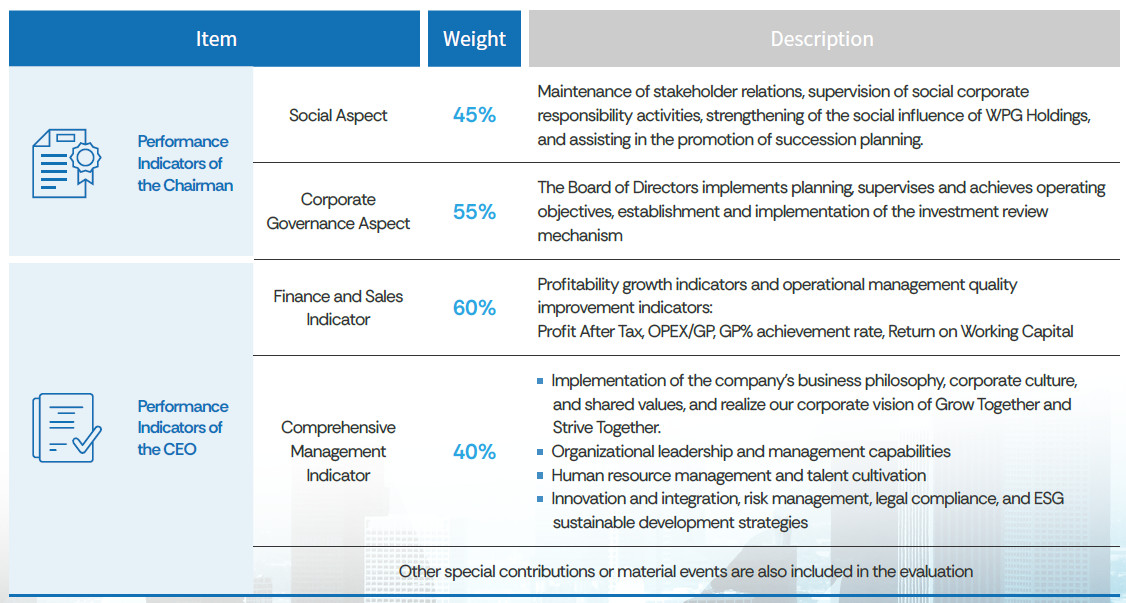

Performance Indicators and Remuneration Structure of Senior Managerial Officers

Senior managerial officers' remuneration structure is highly correlated with performance, and the policies and standards for remuneration policies and performance evaluation are based on internal fairness and external prevailing compensation rates and are reviewed by the Remuneration Committee and then submitted to the Board of Directors for approval and implementation.

Meanwhile, the information about distribution of remuneration to employees and directors shall be included into the report matters at shareholders' meetings each year. The remuneration and performance of the managerial officers are measured by the implementation of the shared values of the Company, the demonstration of senior management performance indicators, leadership and management capabilities, ESG sustainable development strategies, relevant operational performance indicators and other special contributions, etc. The bonus for managerial officers is calculated based on the results of the current year's performance evaluation, and individual amounts of managerial compensation are submitted to the Remuneration Committee for review and approval, and then summarized and submitted to the Board of Directors for approval.

Link between Board of Directors' Compensation and Sustainable Performance

The Company’s Articles of Incorporation stipulate that the Company may pay compensation to its directors, regardless of the Company’s profit or loss, based on the directors' level of participation and contribution to the Company's operations, and in reference to domestic and international industry standards. The Company has established a Remuneration Committee to assist the Board in setting the compensation for directors and senior management, as well as in formulating the overall remuneration policy. A Board Performance Evaluation Policy is in place, under which the Board of Directors and its committees must conduct at least one internal performance evaluation annually, typically after the end of each fiscal year. The evaluation covers the execution and achievement of that year’s objectives. To align with international ESG evaluation standards and strengthen sustainable development, the Audit Committee continues to pursue a goal of ranking within the top 5% in corporate governance evaluations, with its performance incentives tied to the achievement of this goal. If there is a surplus at the end of the fiscal year, the distribution of directors' remuneration will be determined by a resolution of the Board of Directors based on the review and recommendation of the Remuneration Committee. Such remuneration takes into account the Company’s operational performance and each director’s level of participation and contribution. A fair and reasonable link is established between performance-related risks and the compensation received. The standards and reasonableness of director remuneration are reviewed and discussed by the Remuneration Committee at least once per term and submitted to the Board of Directors for approval. The Company will also review the director compensation system from time to time, in light of operational conditions and applicable laws and regulations, to strike a balance between sustainable operations and effective risk management.

Performance Evaluation of the Board of Directors

The company clearly set performance targets to improve the operational efficiency of the Board of Directors to implement corporate governance and improve the functions of the Board of Directors. In December 2015, the Board of Directors formulated the "Procedures for the Performance Evaluation of the Board of Directors ", which stipulated that internal performance evaluation should be reviewed at least once a year. In October 2019, the amendment of the Procedures added that the evaluation shall be performed by an independent professional agency or external expert or scholar team at least once every three years.

- Internal Performance Evaluation of the Board of Directors

The evaluation is performed after the end of each fiscal year, focusing on the overall Board performance evaluation as well as individual self-evaluation. The Board members should individually fill in the self-evaluation form on internal performance

and their individual performance on the Board. The 2024 performance evaluation of the Board of Directors and the committees was submitted to the board on January 21, 2025, and disclosed on the Company’s website.

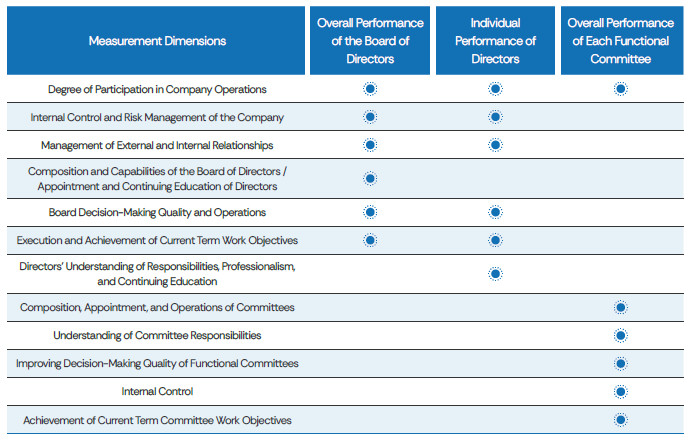

The measurement dimensions for the overall, individual, and functional committee performance evaluation of the Board of Directors include the following :

- External Performance Evaluation of the Board of Directors

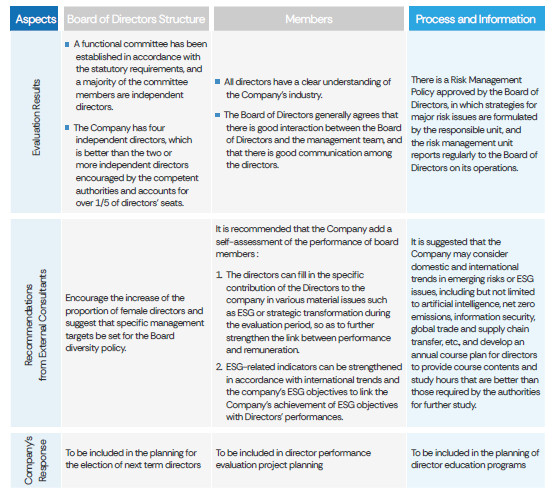

In accordance with Article 3 of the “Procedures for the Performance Evaluation of the Board of Directors,” an external professional independent institution or external expert and scholar team shall be commissioned to conduct the performance appraisal on the Board of Directors once per 3 years. The Company commissioned the external institution, “EY Business Advisory Services Inc.,” to conduct the latest external appraisal in 2022.

It conducted the performance appraisal on the Company’s Board of Directors through questionnaires and on-site visits. The institution and experts are considered acting independently. The appraisal results have been reported to the Board of Directors on December 27, 2022, and disclosed on the Company’s official website.

Directors’ Education

The company continues to promote the development of collective knowledge of the highest governance body. In 2024, the directors attended the continuing training for a total of 69 hours. Averagely, each director attended the training for 7.6 hours. The Company planned the home continuing education courses for the Board of Directors, including “Establishing Sustainable Performance Indicators and Compensation” and “Carbon-Carbon Connection: Discussing Carbon Fees, Carbon Taxes, Carbon Credits, and Trading Rights.” The Company’s Board of Directors members improve their professionalism and focus on sustainable risks and opportunities through continuous participation in a variety of external continuing education courses and focus on sustainability risks and opportunities, perform job duty faithfully and duty of care as good administrator, and exercise their operational decision-making, leadership and supervision functions thoroughly. All newly appointed directors of the company receive an "Onboarding Guide" provided by the company upon assuming office. The content includes integrityrelated regulations such as the " Corporate Governance Best Practice Principles," "Ethical Corporate Management Best Practice Principles," " Code of Ethical Conduct," and "Anti-Corruption and Anti-Bribery Policy," ensuring their compliance with the above provisions while performing their duties.

Conflict of Interest Management

The Board members participate in the parliamentary affairs of the Board of Directors as their routine job duties.

In order to prevent conflicts of interest from affecting the Company’s interests, Article 15 of the Company’s Rules of Procedure for Board of Directors Meetings expressly states the relevant provisions about recusal for conflict of interest. For the implementation of recusal from conflict of interest at the Board of Directors meetings in 2024, please refer to Shareholders Meeting Annual Report - Corporate Governance Status. In order to implement transactions with stakeholders, ensure fairness and enhance the safety and soundness of the Company’s operations, the Board of Directors resolved to establish the “Ethical Corporate Management Best Practice Principles” and the “Code of Ethical Conduct”, which stipulate that transactions should be conducted in accordance with the principles of integrity, priority of the Company’s interests, confidentiality and fair dealing, and that conflicts of interest should be prevented to avoid opportunities for private gain. The Company also established the “Rules for Handling Suggestions and Complaints from Stakeholders” to establish a reporting platform managed by a third party to establish a communication channel with stakeholders.

The “Rules for Handling Suggestions and Complaints from Stakeholders” of WPG Holdings expressly state that the Audit Committee shall serve as the supervisory unit for handling stakeholder suggestions and grievances, and that the third party entrusted with the management of the reporting platform shall report to the Audit Committee on a regular basis. The third party entrusted to manage the reporting platform shall regularly report to the Audit Committee on the progress of the handling of the reported cases, or be subject to the investigation and consultation of the Audit Committee whenever deemed necessary. In 2024, apart from three reported conflict of interest cases, no other significant related incidents occurred.