- Latest ESG News

- Sitemap

- Stakeholder Service

- Management Commitment and Philosophy

- Sustainability Performance

- Corporate Sustainability Management

- Corporate Governance

- Sustainable Supply Chain Management

- Conflict Minerals Management

- Sustainable Envrionment

- Talent Transition and Happiness in Workplace

- Social Participation

- Interactive zone

- Policy and Certificate

- Sustainability Report

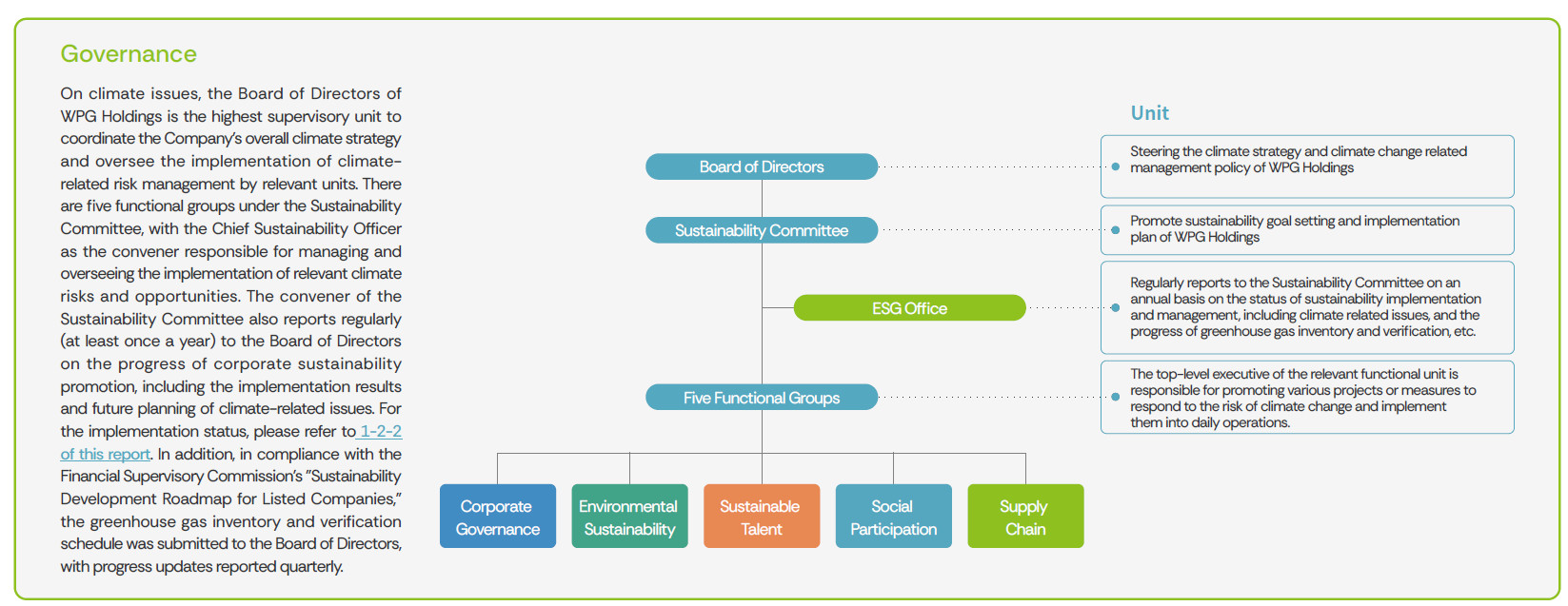

▶️Climate Change Strategy and Management

Task Force on Climate-Related Financial Disclosures (TCFD)

In the face of the global warming crisis, as a global corporate citizen, WPG Holdings supports and responds to the Paris Agreement, striving to reduce greenhouse gas emissions and setting a vision for low-carbon sustainable development. We are committed to minimizing the impact of our operations on the ecological environment and consider compliance with laws and regulations as a basic requirement.

WPG Holdings has made reference to recommendations on climate change-related financial disclosures issued by the Task Force on Climate Related Financial Disclosures of the Financial Stability Board (FSB) of the United Nations and conducted the current situation analysis, climate risk and opportunity identification, and scenario analysis of climate change-related financial disclosures, which are described in the following four scopes :

Strategy

With reference to the TCFD guidelines, we identify 5 climate change risks and 5 opportunities of WPG Holdings through workshop discussions and assessments of climate related issues. The impact period of climate risk is divided into short-term (1~3 years), mid-term (3~10 years), and long-term (more than 10 years).

- Climate Change Management Policy and Response Actions

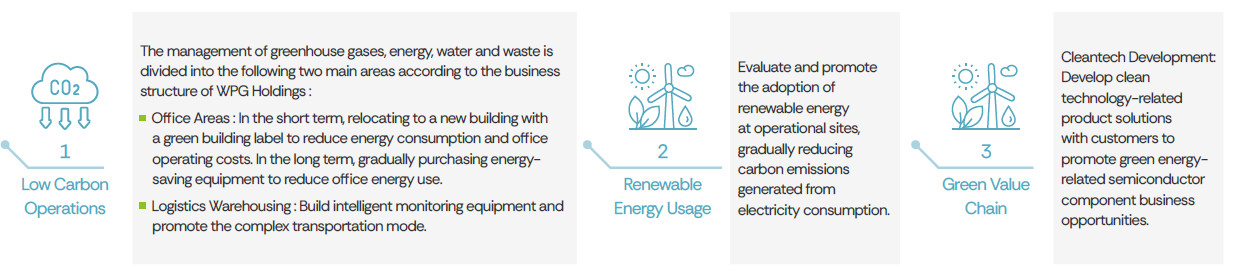

In response to the key risks and opportunities caused by climate change, WPG Holdings has established the following management plans to address the issues of low-carbon operations and promotion of green value chain:

Climate Change Scenario Analysis

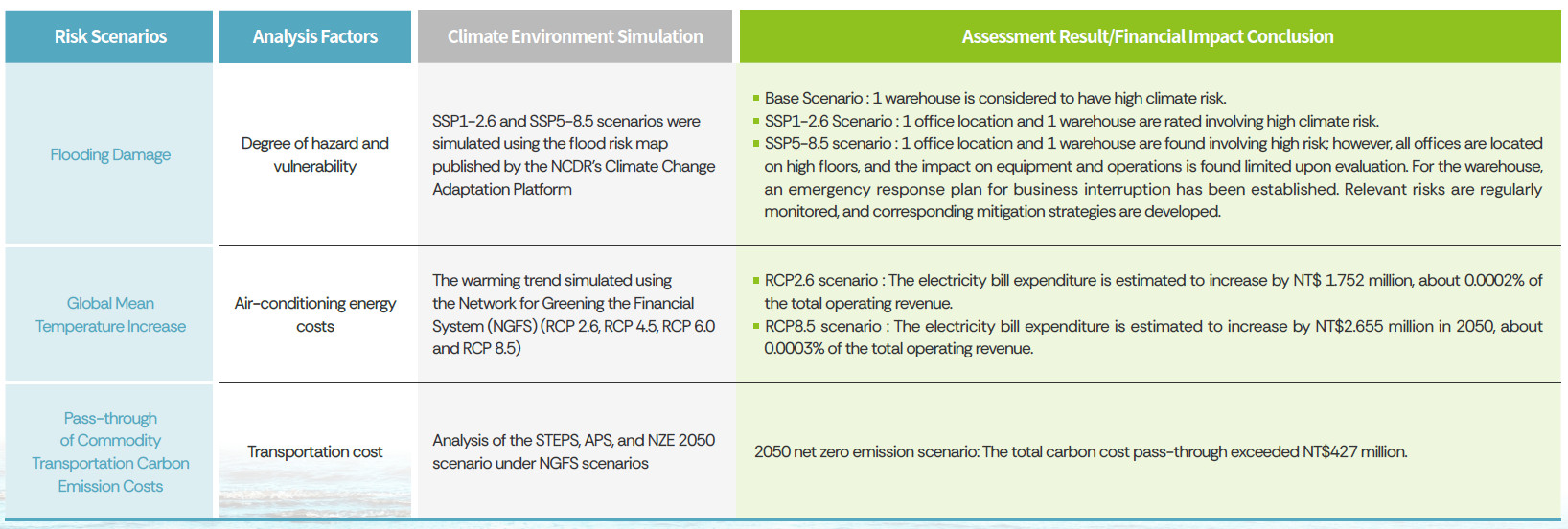

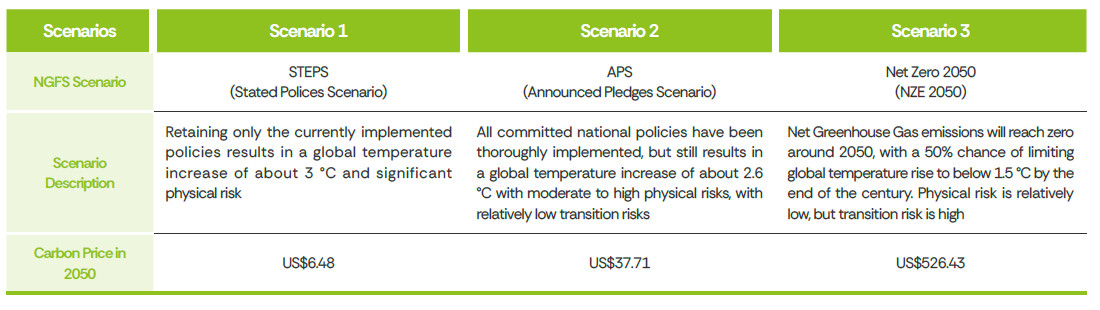

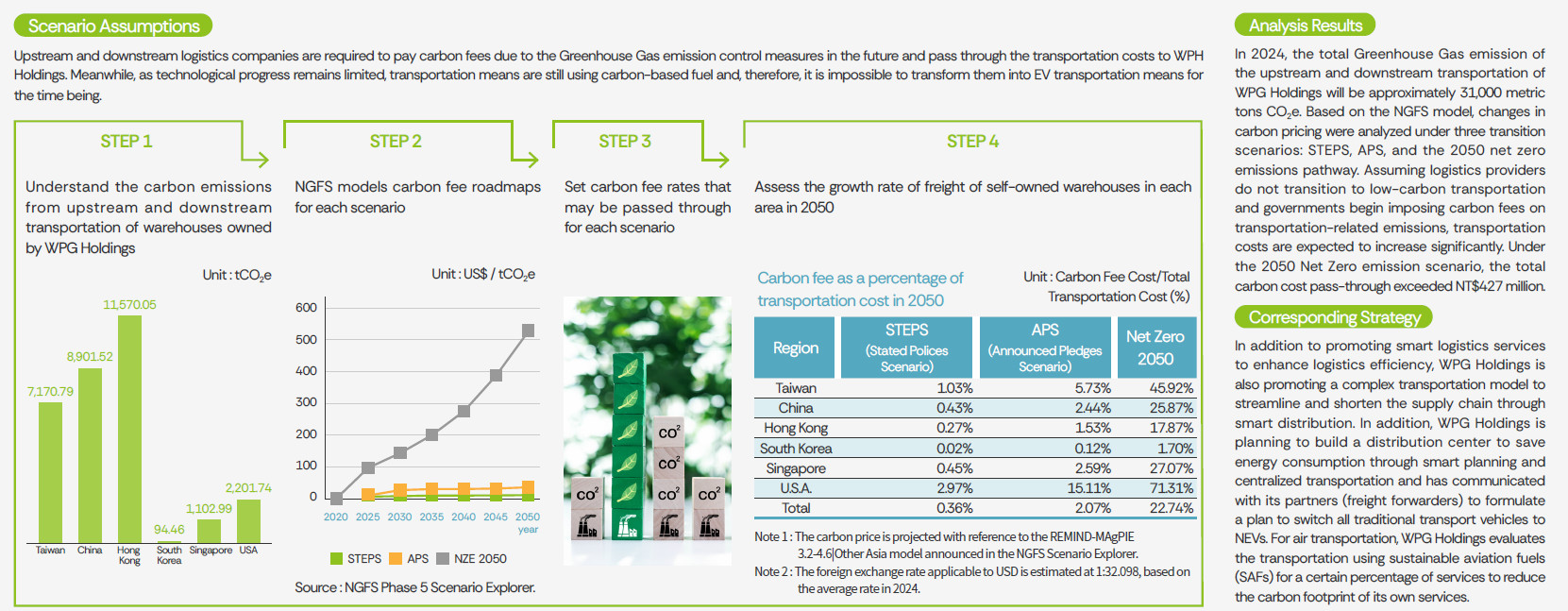

The global average temperature rise controlled within the range of 1.5°C is the goal for all of the people. However, there is still a considerable gap between various countries’ policies and this goal. In order to respond to the risksand impacts caused by various possible climate paths in the future, WPG Holdings, through the climate change scenario analysis, assessed 2 physical risks (flooding disasters and global mean temperature Increasing) and 1 transition risk (pass-through of the carbon emission costs for transportation of commodities), as well as the risk impacts under various scenario hypotheses. Meanwhile, it also formulated appropriate response strategies to mitigate the potential impacts posed by climate risks. The risk scenarios, analysis factors and assessment results are disclosed as follows :

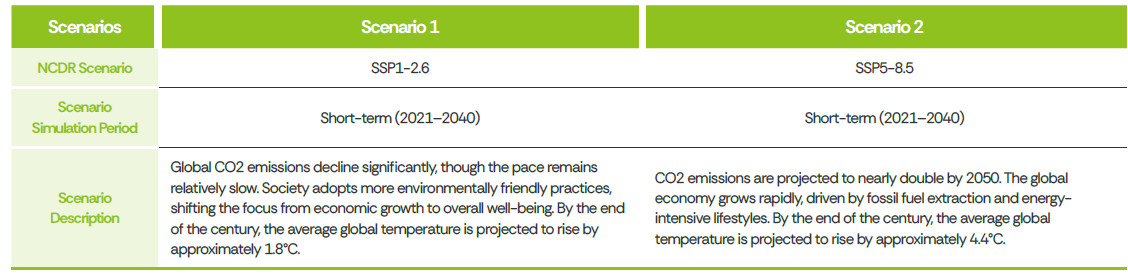

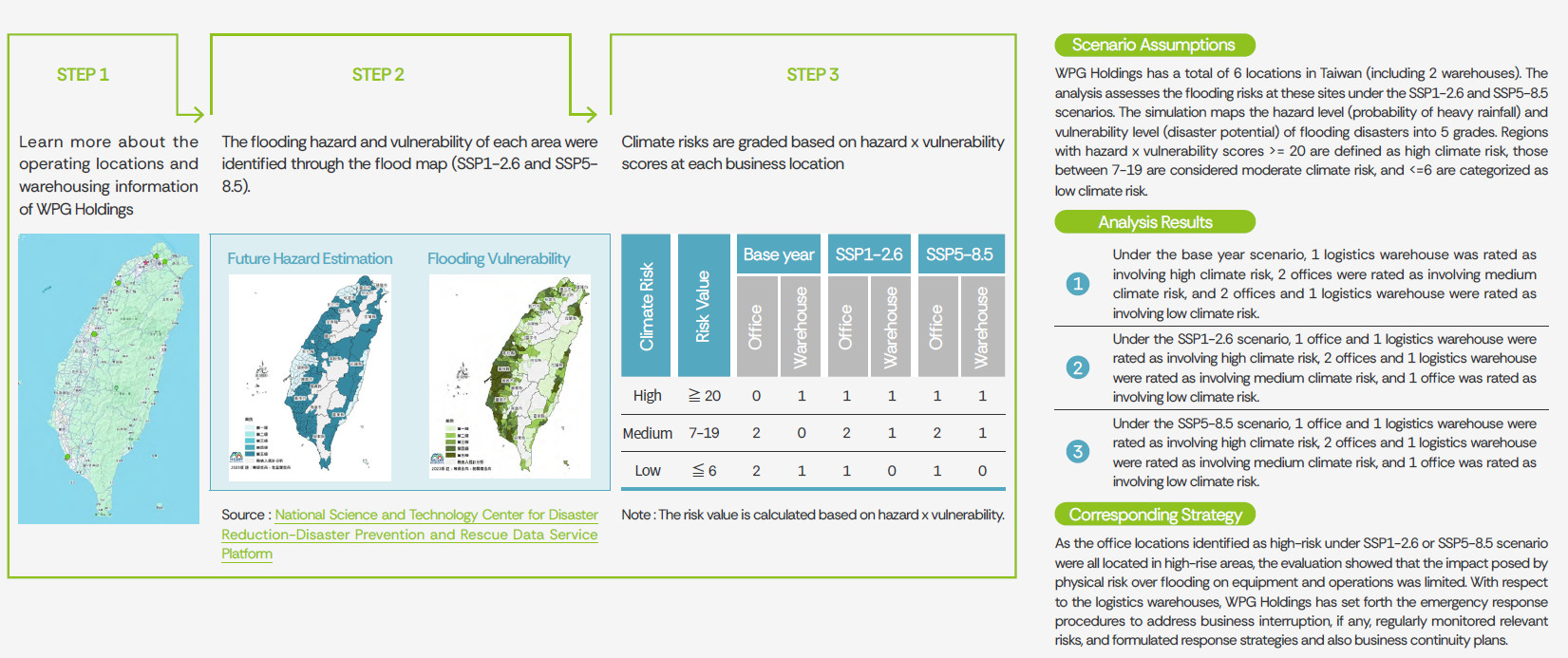

In recent years, extreme rainfall events have become more frequent and have caused large-scale flooding events. As the leading distributor of semiconductor components in Asia Pacific, WPG Holdings has set up operating locations and logistics warehouses globally. However, due to the lack of universally comparable and accurate global risk mapping information, the 2024 assessment primarily referenced the flood disaster risk maps published by Taiwan's National Science and Technology Center for Disaster Reduction (NCDR) on their Climate Change Disaster Risk Adaptation Platform. The priority was to simulate scenarios for the Taiwan region and assess the impacts on various sites under different climate scenarios. The selected scenarios include short-term SSP1-2.6 and SSP5-8.5 short-term climate scenario, while also conducting impact assessments based on the current base-year risk.

- Acute Physical Risk - Flooding Damage

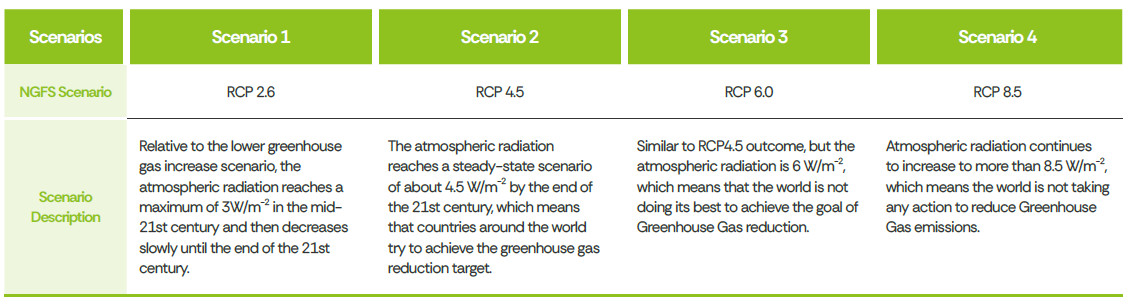

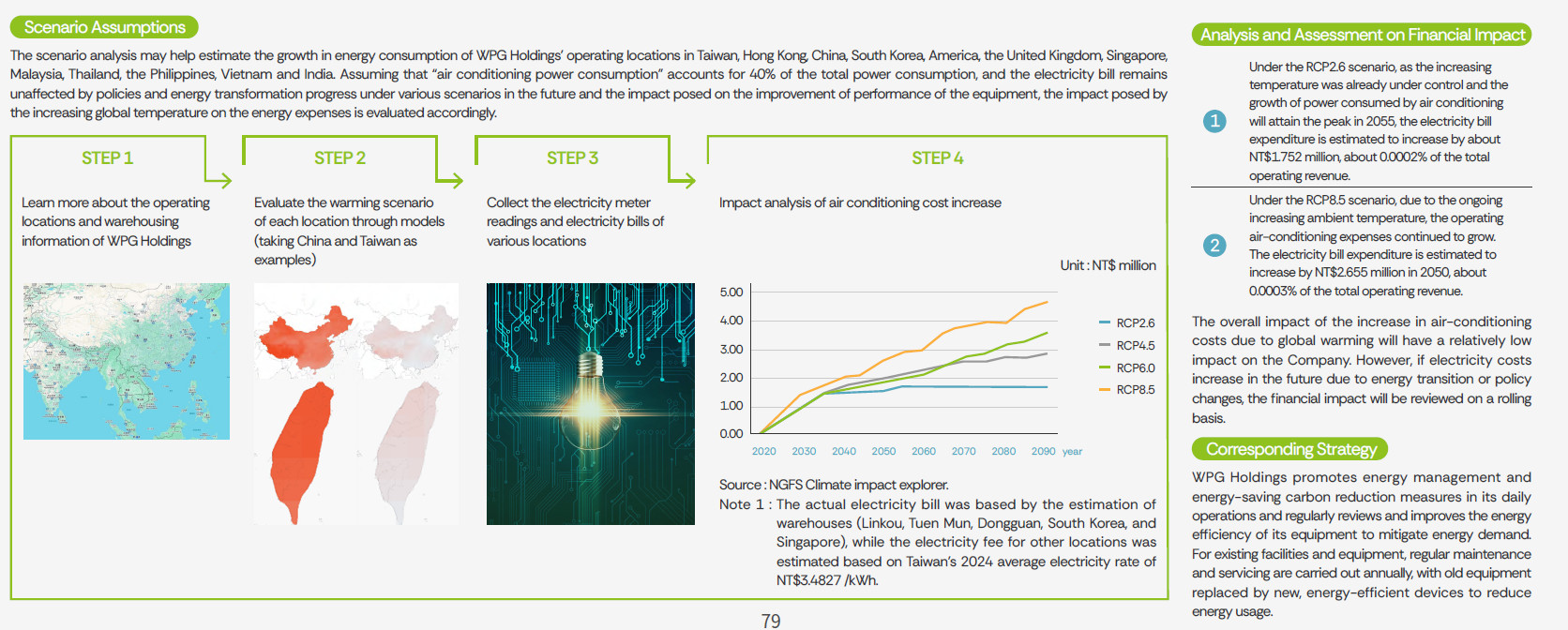

The most direct impact of the global mean temperature rise is the growth of energy demand for air conditioning, WPG Holdings is a semiconductor components distributor, with its operational locations primarily consisting of offices and logistics warehouses. During its operations, energy consumption is concentrated in smart warehousing systems and air conditioning equipment, with electricity usage for air conditioning being the main source of energy consumption. The Company simulates the temperature change of each location under different global average warming environments and the warming trend under different scenarios (RCP 2.6, RCP 4.5, RCP 6.0, RCP 8.5) by referring to the Networking for Greening the Financial System (NGFS) and estimates the occurrence time and financial impact of global mean temperature increase through electricity usage and average electricity cost of each location.

- Chronic Physical Risk - Global Mean Temperature Increase

In order to reduce Greenhouse Gas emissions, the trend in recent years has been to levy carbon fees or carbon taxes on carbon emissions, forcing manufacturing companies to begin to focus on greenhouse gas reduction. Although WPG Holdings is not a large greenhouse gas emitter, but the upstream and downstream logistics and transportation process may also generate a large amount of Greenhouse Gas emissions. If the future for the transport of Greenhouse Gas emissions need to begin to collect carbon fees, it may face the logistics manufacturers due to the imposition of carbon fees and pass on costs, resulting in increased costs of transportation. The Company referenced the Network for Greening the Financial System (NGFS) to simulate changes in carbon pricing under various transition scenarios. Based on the estimated greenhouse gas emissions from upstream and downstream transportation at each warehouse, the potential cost pass-through from logistics and transportation was assessed.

- Transition Risk - Commodity Transportation Carbon Emission Cost Pass-Through

Risk Management

The climate change risk management procedures of WPG Holdings have been integrated into the general risk management. For details, please refer to 2.2.2 herein. By identifying risks, it defined six major risks, including environmental risks (business interruption caused by natural disasters, etc.) and has established the emergency response procedures to address business interruption. The climate risk management process consists of three major steps, namely, “Identification and Assessment,” “Monitoring and Response,” and “Report.” Further, WPG Holdings has started to conduct Greenhouse Gas inventory and allocates an annual budget each year since 2021. The action cost invested in managing the climate risk in 2024 was less than 0.001% of the total operating revenue.

- Climate Change Risk Management Process

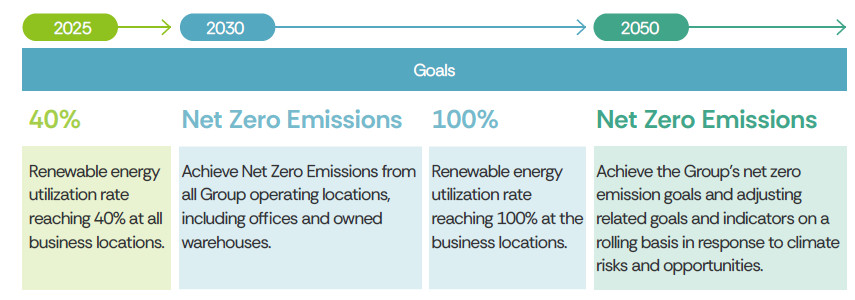

Metrics and Targets In order to implement sustainable management and achieve the Group’s declared goal of Net Zero Emissions, WPG Holdings conducts annual greenhouse gas inventories and further verifies the credibility and consistency of emission data through third-party verification and continues to expand the Group’s scope of greenhouse gas inventories and verification, as well as publicly disclose relevant content of climate-related financial disclosures.

- Net Zero Vision and Roadmap of WPG Holdings

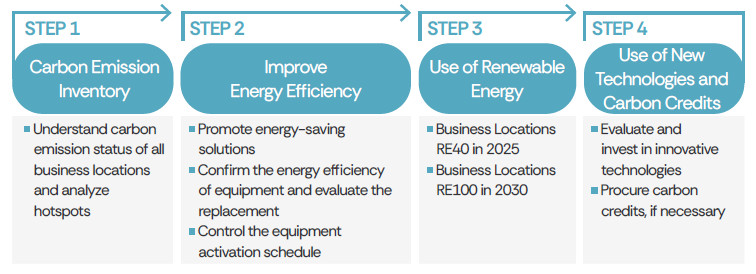

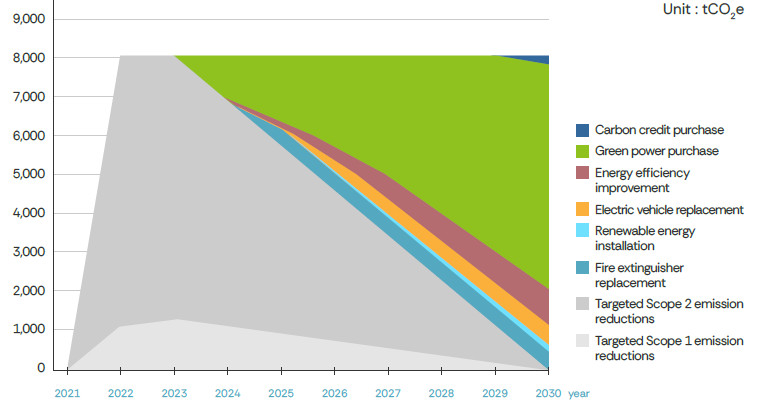

Achieving net zero emissions by 2050 is the goal of WPG Holdings. In addition to the Group’s overall carbon emission inventory, our net zero vision is based on the science based (SBTi) reduction roadmap, and it promotes the company to move toward net zero in three steps, including “improving the energy utilization rate (energy conservation), use of renewable energy and removal of new technology/(carbon credit) crediting residual emission.”

To achieve Group’s Scope 1 and Scope 2 net-zero targets by 2030, the Company convened key operational sites and responsible departments to jointly develop decarbonization plans. Leveraging currently available carbon reduction technologies, the Company formulated actionable strategies and set annual emissions reduction targets. Through clear planning and implementation, the Company aim to systematically reduce overall carbon emissions. Moving forward, the Company will adapt our decarbonization strategies as needed based on actual conditions and regularly track performance to ensure we remain on course to meet goals.

WPG Holdings recognizes the critical role of biodiversity in maintaining ecological stability and balance and believes that biodiversity conservation should go hand in hand with business development. In 2024, biodiversity was incorporated into the Company’s sustainability management topics, with close attention paid to the potential impacts of operational activities on biodiversity. Where impacts are identified, the Company will proactively implement mitigation measures to ensure a harmonious balance between business growth and environmental preservation.

Biodiversity is not only a key factor in ensuring the sustainable use of natural resources, but is also closely linked to climate change mitigation, carbon cycling, and water resource management. Through environmental management, WPG Holdings aims to minimize the ecological impact of its operations. The Company also closely monitors international biodiversity governance frameworks, including the Convention on Biological Diversity (CBD) and the Kunming-Montreal Global Biodiversity Framework (GBF), to ensure that its corporate strategies align with global sustainability trends.

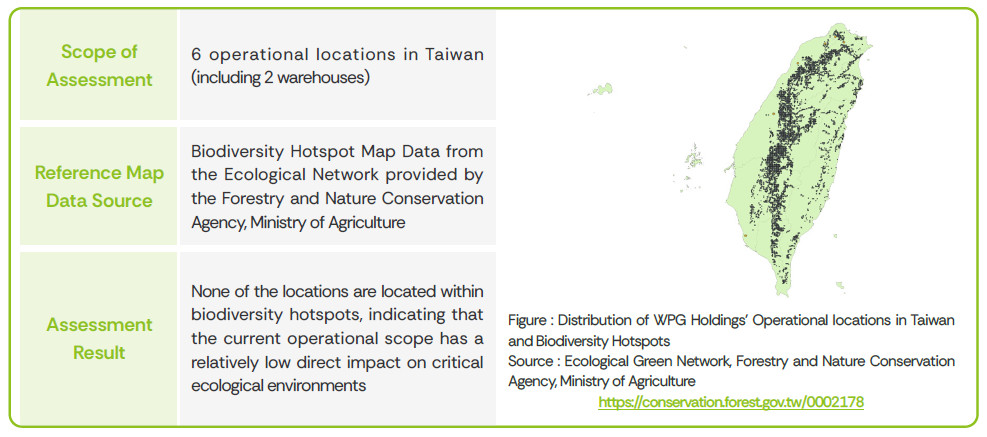

Biodiversity Impact Assessment

To further strengthen biodiversity management, WPG Holdings conducted a biodiversity impact assessment for 6 operational locations in Taiwan, including 2 warehouses. The assessment utilized biodiversity hotspot data from the Ecological Green Network provided by the Forestry and Nature Conservation Agency under the Ministry of Agriculture, to determine whether any sites are located within biodiversity hotspots. The results indicated that none of the Company’s operational sites are situated within biodiversity hotspots, suggesting that the current scope of operations has a relatively low direct impact on critical ecological environments. Nevertheless, WPG Holdings will continue to monitor the potential ecological impacts of its business activities and incorporate biodiversity considerations into site selection criteria for future construction or expansion projects, in order to minimize environmental disturbance.