- Latest ESG News

- Sitemap

- Stakeholder Service

- Management Commitment and Philosophy

- Sustainability Performance

- Corporate Sustainability Management

- Corporate Governance

- Sustainable Supply Chain Management

- Conflict Minerals Management

- Sustainable Envrionment

- Talent Transition and Happiness in Workplace

- Social Participation

- Interactive zone

- Policy and Certificate

- Sustainability Report

▶️Cleantech Strategy and Development

WPG Holdings is a distributor (agency/distribution) of semi-conductor components and parts, but not involved in the manufacturing and sales of end products. However, as a part of the Green Value Chain, in response to Clean tech’s growth demand and operating revenue from related applications, WPG Holdings collaborates the business partners in the upstream and downstream sectors of the supply chain to focus on the R&D, expenditure and promotion of Clean tech’s applications.

Meanwhile, it establishes the WPGDADATONG solution technology sharing platform, seeks the platform information transparency, strives for users’ participation in and use of clean technology solutions, creates business opportunities for each other and expands corporate profits.

WPG Holdings upholds the spirit of serving industry partners and strives to become an intermediary promoter for connecting link between the preceding and the following for the Cleantech and collaborate with partners in the industry to maintain its leading position, and plans and promotes the following three strategic directions.

Promoter of WPGDADATONG Platform Cleantech Application Solutions

WPG Holdings continues to invest in clean technology-related applications to strengthen its R&D capabilities. In 2024, the company had a total of 135 development engineers (RD & FAE), representing an increase of 5 compared to 2023. This expansion aims to enhance the company’s technological innovation capacity in response to growing market demand. Significant investments were also made in hardware infrastructure. The operational area expanded to 364 square meters , and one additional power electronics laboratory was established in Shanghai, bringing the total number of such laboratories to 11. These include a new energy high-voltage lab, an environmental simulation lab, an EMI chamber, an electromagnetic isolation lab, a network communication lab, among others. The operational team of the WPG website, WPGDADATONG, was expanded to 6 members, enabling more efficient optimization and maintenance of both front-end and back-end interfaces. These efforts support WPG Holdings in showcasing and promoting clean technology solutions more effectively, while also reducing the carbon footprint associated with physical interactions.

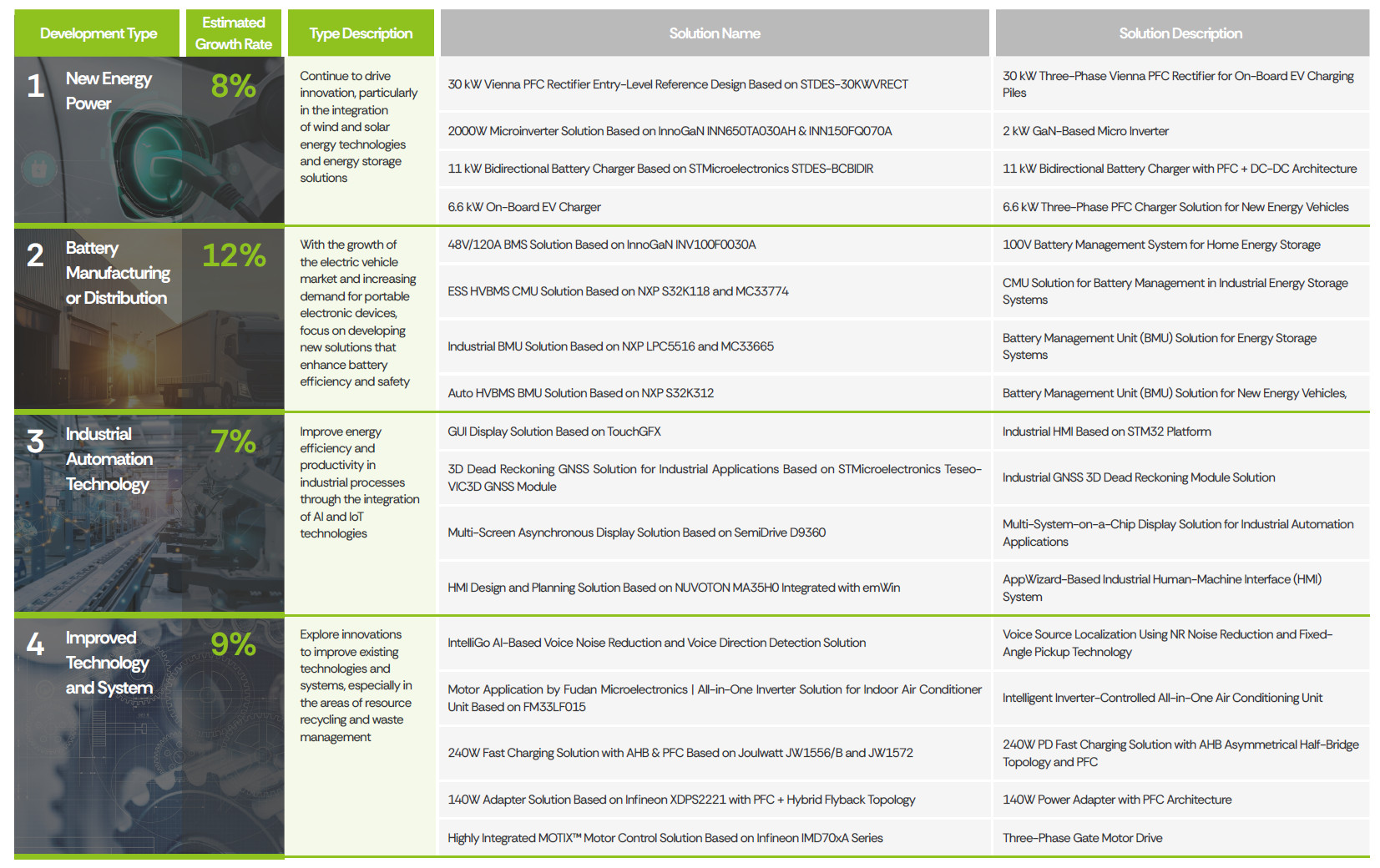

In 2024, WPG Holdings developed and updated a total of 150 clean technology-related solutions, representing a significant increase compared to 137 solutions in 2023. These solutions span a wide range of applications, including new energy development, battery manufacturing or transportation, industrial automation technology production or transportation, smart metering device manufacturing or transportation, LED lighting development or transportation, traditional pollution control development and transportation, and technological system improvement and development or transportation.

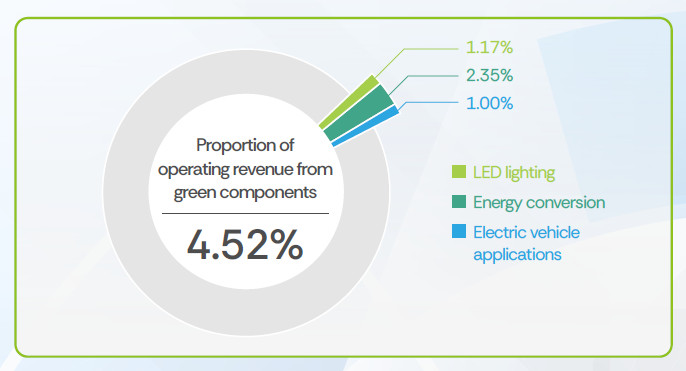

Energy conversion and LED lighting markets remain the core of WPG Holdings' business, showing signs of maturation alongside shifts in customer structure. Despite this, the decline in unit prices of LED components led to a 15% year-over-year decrease in sales revenue. Nonetheless, the company continues to mitigate this downward trend through innovative product development and market expansion efforts.

In the high-potential energy conversion and storage market, WPG Holdings maintained strong growth in products such as IGBTs (Insulated Gate Bipolar Transistors), power management solutions, solar chips, and third-generation semiconductors. Sales revenue in this segment grew by 5% year-over-year, accounting for approximately 2.3% of total revenue, highlighting the company’s effective strategic positioning and market expansion in this field.

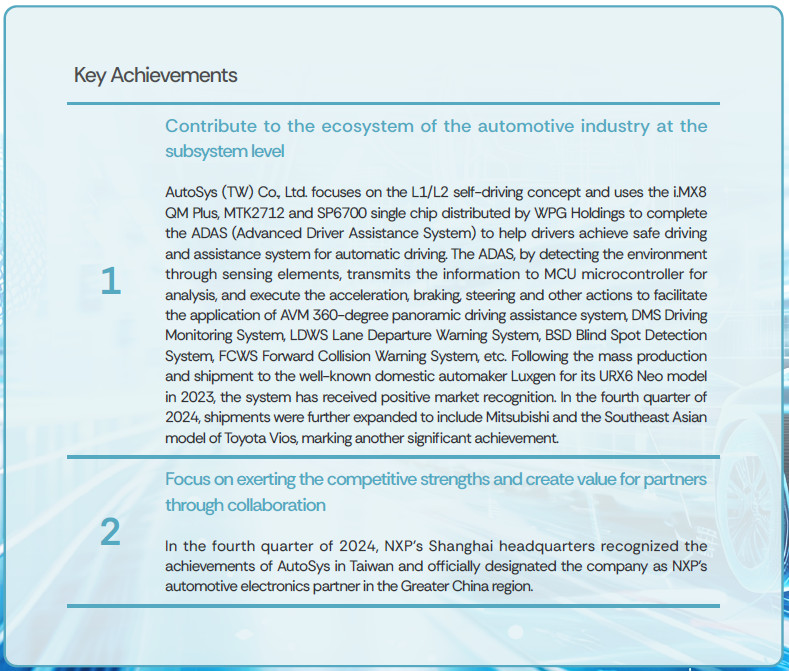

Combining External Technology

WPG Holdings invested NT$75 million in the external company, AutoSys (TW) Co., Ltd., to promote the development of advanced driver-assistance systems (ADAS) and smart cockpit products for electric vehicles. In 2023, the company achieved a key milestone with the mass production and delivery of these solutions to the well-known domestic automaker Luxgen for its URX6 Neo model, which has since received positive market recognition.

Advancing Key EV Technologies through Solution Development

In 2024, WPG Holdings developed 65 electric vehicle (EV) application solutions along with over a hundred technical blog articles, accounting for 25% of the total solution portfolio. The latest developments focused on smart vehicle body electronics, third-generation semiconductor applications, and energy management systems. Among the newly added solutions, key highlights included innovative sensing technologies and intelligent power management, such as the adoption of advanced SiC and GaN technologies to improve automotive energy efficiency, as well as the development of advanced battery management systems, fast charging technologies and infrastructure, and smart cockpit systems. The sales value of green components related to these solutions increased by 12% year-over-year compared to 2023, accounting for approximately 0.7% of total operating revenue. These achievements demonstrate WPG Holdings’ growing technological capabilities and market influence in the EV sector, while contributing to sustainable development and technological innovation across the industry.

WPG Holdings continues to expand its presence in the clean technology sector by developing a broader range of application solutions to meet evolving market demands. Cleantech-related solutions cover the applications under 7 major categories. In 2024, WPG Holdings developed and updated 150 Cleantech-related solutions, covering new energy development, battery manufacturing or distribution, industrial automation technology manufacturing or distribution, smart metering device manufacturing or distribution, LED lighting development or distribution, traditional pollution control development and distribution, and improved technology and system development or distribution. These accounted for 70% of the total solution portfolio in 2024, with operating revenue growing by 43% from the same period of 2023. Among these, green components contributed to 4.52% of WPG Holdings' total revenue, including 1.17% from LED lighting, 2.35% from energy conversion, and 1.00% from electric vehicle applications.

WPG Holdings looks ahead to the future development of clean technology, continuing to delve into and expand the field of clean technology. With the continuous iteration of clean technologies and the solid support of related policies, the period from 2025 to 2027 is expected to be a phase of steady growth. Among the key drivers, new energy and battery technologies will continue to play a leading role, while applications related to smart cities—such as smart metering devices and intelligent lighting—are projected to experience significant advancements.